Forecasting – a helpful look into the future

Thanks to a forecasting model developed by statistician Costas Leon, GLANDON knows how many apartment requests will be received in the coming week or month.

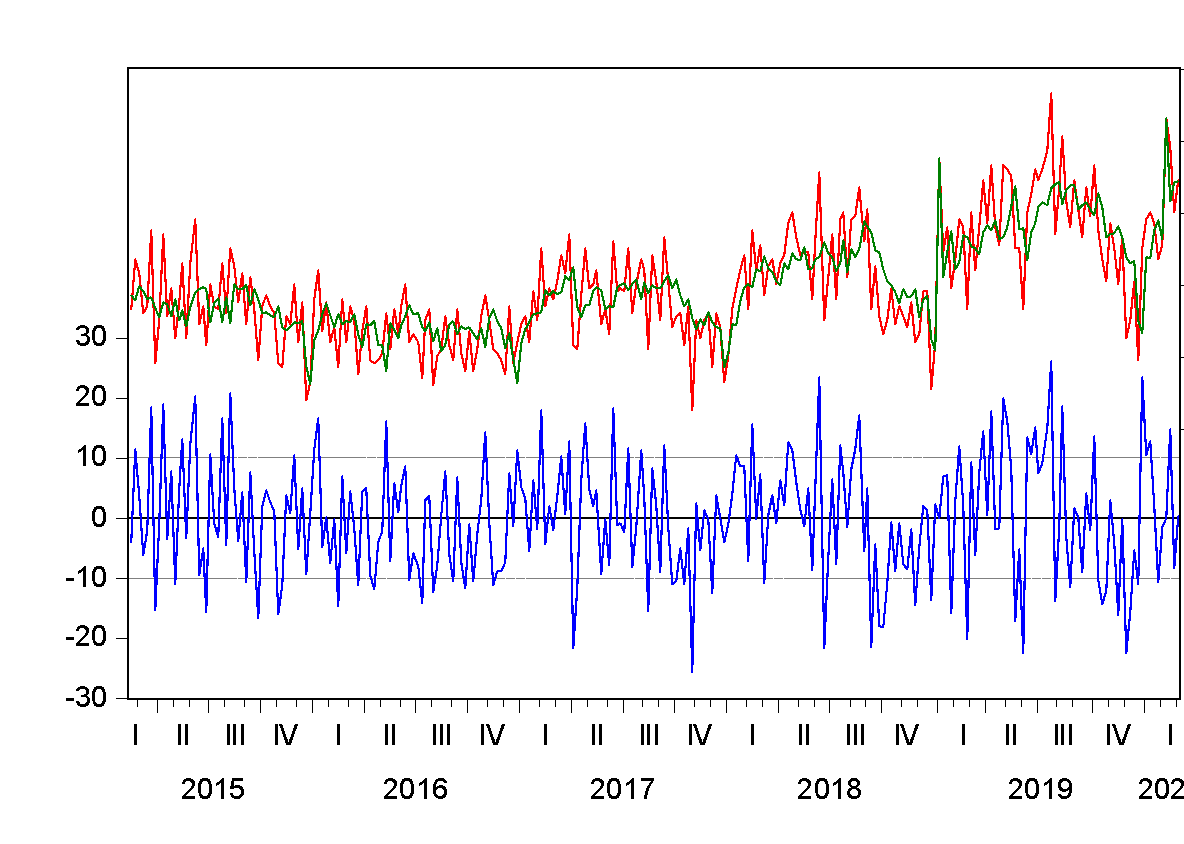

In February, the apartment demand index forecast for March 2020 was 208 units, 11 units higher than in February 2020, according to a model belonging to the broad class of ARFIMAX models and developed by statistician Costas Leon. This type of models is based on memory properties of dynamic systems and uses advanced econometric methods and tests. The chosen methodology is called General-to-Specific Modelling and was developed at the London School of Economics and the Department of Economics at the University of Oxford (England). As Costas Leon explains, each model always consists of two parts: the signal and the noise. The signal can be predicted by the model, but the noise cannot. The model tries to maximize the signal and minimize the noise as much as possible (see Figure). There are many ways to do this. Scientific knowledge and experience play an important role in building models. The forecast for March 2020 was fairly accurate, as the actual index was 215 units, only 7 units higher than the forecast. «However, every forecast is not expected to be as accurate as this one», says Costas Leon.

Figure: Index of actual initial requests (red), index of estimated initial requests (signal, green) and residuals (noise, blue).

Point Prediction vs. Prediction IntervalsAt the beginning of the week (Monday, 10 a.m.) 108 units were forecast for the index of apartment requests from 6 to 12 January 2020. The actual value was 118 units and the deviation from the forecast was small. This is an optimal point forecast. However, forecast intervals show a more accurate picture. For example, the model predicted for the selected January week that the expected index of the number of requests would be between 97 and 129 with a 95 percent probability. «It is not possible to give more precise figures because noise is quite high in our business», explains Costas Leon.

Since the beginning of 2019, the error of the model (mean absolute percentage error) is 16.31 % for weekly forecasts and 10.93 % for monthly forecasts. In almost all cases, the optimal point forecasts were within a 95 percent forecast interval. The greatest inaccuracy was found in July 2019. The actual value was much higher than the forecast. «From a business perspective, it is of course gratifying when more people are interested in an apartment», says Costas Leon. «But it usually also means that structural instability is imminent, as it sometimes happens in a fast-growing environment». This instability at GLANDON began in early January 2017, when seasonal variations, longer cycles and upward trends in demand began to play a significant role. Holidays and extreme values are taken into account in the model. Due to instability, Costas Leon always revises the weekly and monthly models at the beginning of the week or month on the basis of the past information set.

Model contributes to overall efficiencyHow can such forecast models help a company? «It depends a lot on how you use them. A model delivers numbers. But we still have to interpret them ourselves and draw conclusions from them», explains Costas Leon. At GLANDON Apartments, the evaluations could help the company in several areas. «For example, as support for the sales team», says Leon. If the sales team knows how many inquiries are coming in, it can use its time more efficiently. The number of check-ins and visits to the apartments can also be better planned in advance thanks to the forecast model. Furthermore, the breakdown of the enquiries into long-term trend, cycle and seasonal fluctuations makes it possible to determine the prices of the apartments in such a way that the occupancy rate increases. This in turn contributes to the overall efficiency of GLANDON Apartments.